What is a neolender?

The majority of neobanks focus on retail banking, with some offering SME accounts as a supporting product. Over the last 5 years, we’ve seen them rise with neobanks like Monzo, Chime, N26, NuBank, and others attracting tremendous growth and raising large capital rounds from venture capital and other sources of investment.

During COVID, some of these neobanks are finding it incredibly difficult to continue to grow and attract more venture capital. Their revenue streams and growth have often been reliant upon deposits, transactions and payments. As users have stopped traveling and their incomes have suffered, the neobank’s revenues have taken a downturn. For some neobanks, there is also a heavy reliance on venture capital to provide the capital resources necessary to survive and grow. This reliance on venture capital has placed into question their sustainability should venture capital markets continue to be timid during the pandemic.

The neobank market is segmenting

As the neobank sector has matured, naturally there has been segmentation within the banking space to focus on specific verticals to drive revenue growth.

Some of these verticals that are seeing solid growth include:

- Foreign Exchange — TransferWise, Xe.com, Revolut

- Savers — Yield Street, Dave.com

- Cards — DiviPay, Emburse

- Lending — Atom Bank, OakNorth

What we also noticed is a rise in the non-bank, ’neolenders’, offering lending as their first product with other banking products and services integrated into the experience.

Why start with lending?

It’s no secret that traditional banks make the majority of their incomes via lending and fees. They gain access to capital and lend it out to borrowers at more than the cost of the initial capital. The difference is called net interest margin or NIM.

Many of the first neobanks pivoted into lending as their main source of revenue after launching their own digital banking experience. Many of them suggested they wished that they’d started lending to their clients earlier in their growth.

As the neobanking market has matured, ‘neolenders’ have started to offer a lending-first proposition that is supported with other digital banking capabilities like accounts and payments.

Companies like Zopa, RateSetter, Wisr, Commonbond, Credit Club & Better.com, to name a few, are using lending products and services to gain revenues and a customer base initially before widening their offerings with other products and services.

This approach often enables the company to grow with its own revenues rather than rely upon venture capital or other forms of investment as the major source of capital.

Synapse for neolenders

At Synapse, we’ve recently released our lending-as-a-service offering which enables anyone to become a lender or ‘neolender’. We offer an API-first platform and scalable business model for any company looking to offer lending products to their customers. A unique value proposition for clients of Synapse is we adhere to compliance requirements including licensing, reporting, and regulatory compliance as the lender of record, so you can take comfort in knowing that we take regulatory compliance seriously.

We give you the ability to issue and service both one-time loans and recurring loans. These loans are customizable and instantly disbursed to a user upon origination. Define your own APR (Annual Percentage Rate) so long as it meets our non-predatory lending criteria and set up limits, custom decision criteria, and a range of other custom details to enhance user experience.

Our end-to-end platform enables you to manage credit reporting, access KYC (know your customer) requirements, enable payments, settlements, and other back-office functionality on one platform, streamlining time to market.

We also are continually updating our platform with new and exciting features that offer our customers new ways to enhance their customer experience and capabilities.

Comparison

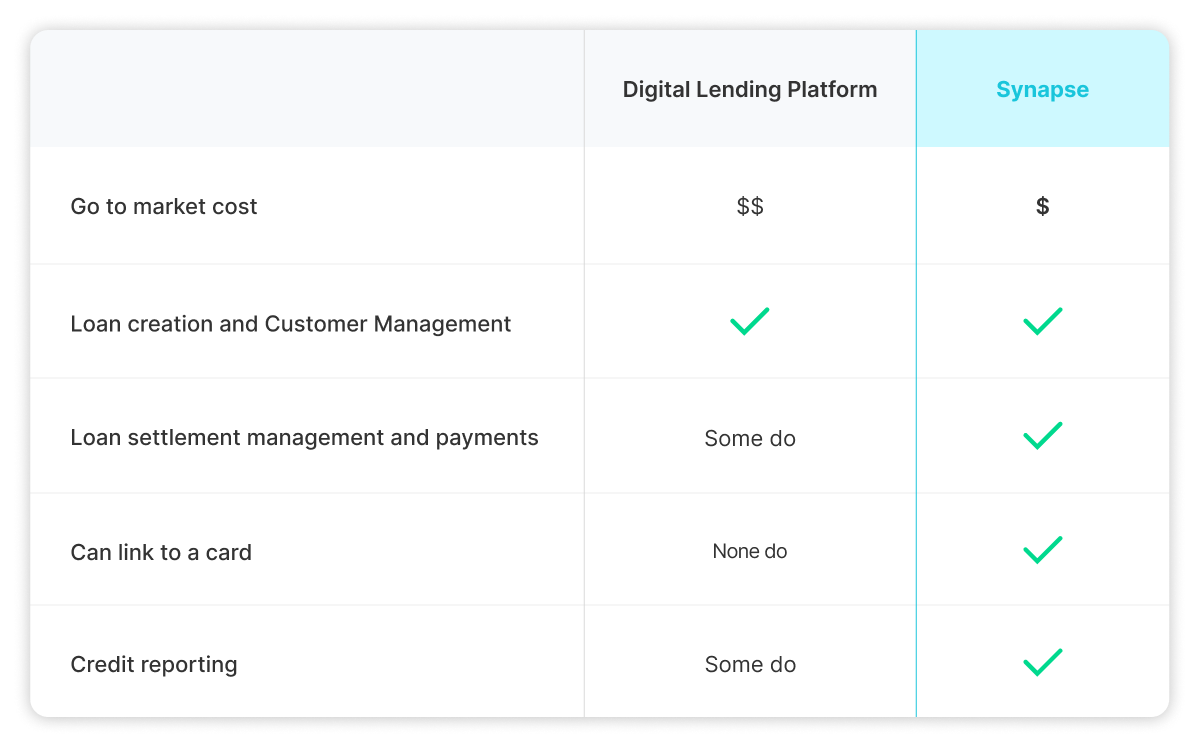

For new or existing lenders, Synapse offers a simple and scalable platform. See how we compare:

Summary

More neobank companies are coming to market with lending being the primary revenue driver and focus. As neobanks continue to disrupt traditional banks, the new vertical of ‘neolenders’ are providing compelling solutions that serve the needs of their customers and enable a strong revenue foundation to grow from. We are excited to support new waves of innovation, particularly in the lending space.